Irs 2018 Social Security Worksheet

Employer social security taxes paid by the lodge.

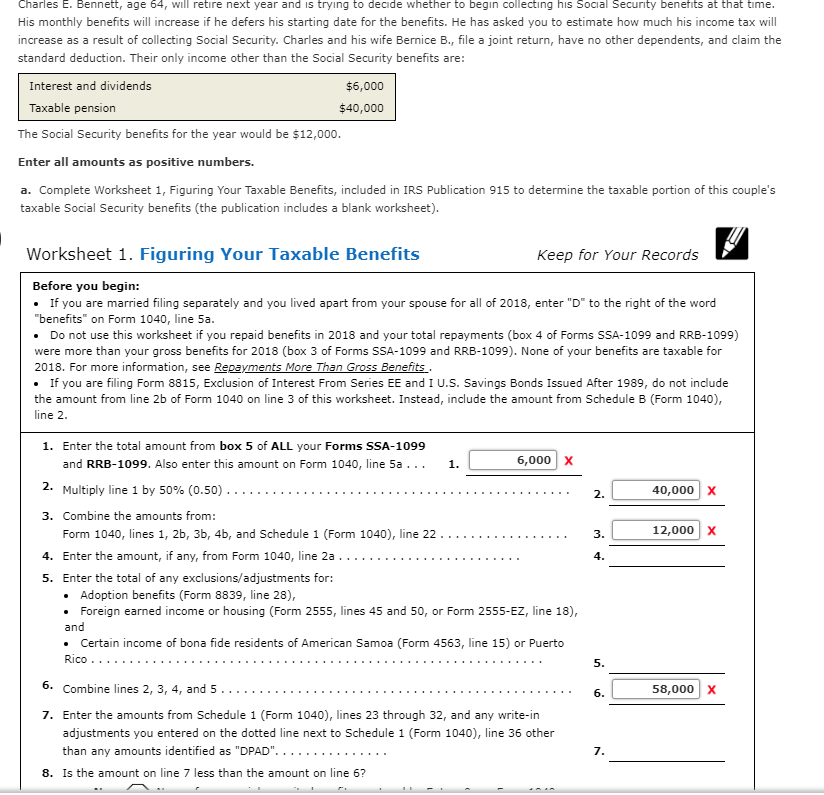

Irs 2018 social security worksheet. If your social security andor ssi supplemental security income benefits were your only source of income for 2018 you probably will not have to file a federal income tax return. Jane also received 5000 in social security benefits in 2019 so her total benefits in 2019 were 11000. Social security benefits worksheet. Individual income tax return.

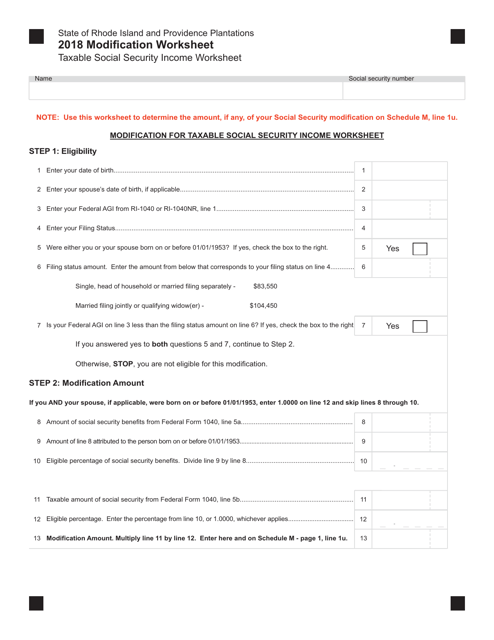

None of your benefits are taxable for 2018. If married filing separately and taxpayer lived apart from his or her spouse for the entire tax year enter d to the right of the word benefits on line 5a. In 2019 she received a lump sum payment of 6000 of which 2000 was for 2018 and 4000 was for 2019. Worksheets for figuring your taxable benefits.

Social security benefits worksheet 2018 before filling out this worksheet. Figure any write in adjustments to be entered on the dotted line next to schedule 1 line 36 see the instructions for schedule 1 line 36. Calculator for 2018 irs publication 915 worksheet 1 by a noonan moose on august 6 2018 this calculator figures your taxable social security benefits based upon the irss 2018 form 1040 2018 schedule 1 and 2018 publication 915 worksheet 1 which was published january 9 2019 and made no substantive changes to the 2017 worksheet calculations. Faqs forms publications tax topics worksheets.

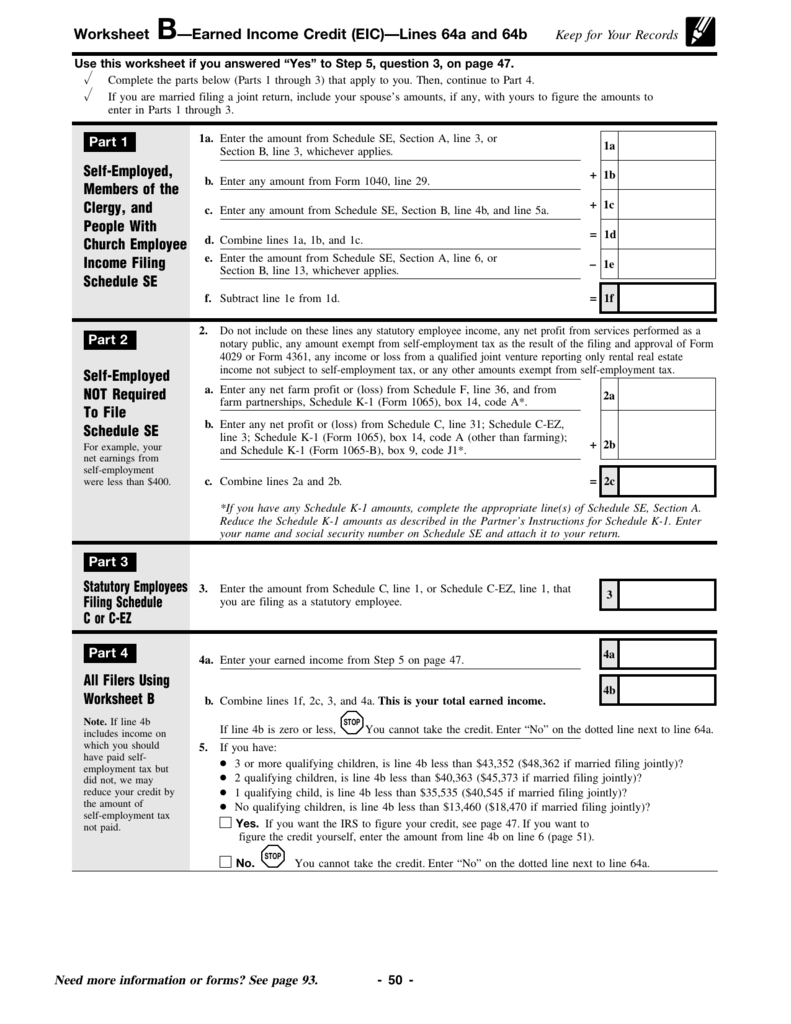

The net amount of social security benefits that you receive from the social security administration is reported in box 5 of form ssa 1099 social security benefit statement and you report that amount on line 5a of form 1040 us. Keep for your records. These worksheets are provided to help you figure your taxable ministerial income your allowable. Dont use this worksheet if you repaid benefits in 2018 and your total repayments box 4 of forms ssa 1099 and rrb 1099 were more than your gross benefits for 2018 box 3 of forms ssa 1099 and rrb 1099.

Social security benefits. Comments about tax map. Publication 517 social security and other information for members of the clergy and religious workers worksheets worksheets. Exempt organization tax topic index.

Total social security taxes to deposit monthly for this salary. 2018 social security benefits worksheet. Gross monthly salary tax rate lodge taxes paid x 62 social security x 145 medicare total. Figure any write in adjustments to be entered on the dotted line next to line 36 schedule 1 form 1040.

In 2018 she applied for social security disability benefits but was told she was ineligible. Social security benefits worksheetlines 5a and 5b. How much is taxable. 501 or your tax return instructions to find out if you have to file a return.