Irs Audit No Receipts

Many of the expenses are for 10 50.

Irs audit no receipts. Additionally make sure you understand the irs receipt requirements so you can keep detailed records. All you need is a reasonable basis to recreate the expense and credible testimony that you actually spent the money. Can you prove expenses in an irs audit without receipts and checks. I am comparing the receipts that i saved and my creditdebit card statements and i realize that i didnt save receipts for many business expenses.

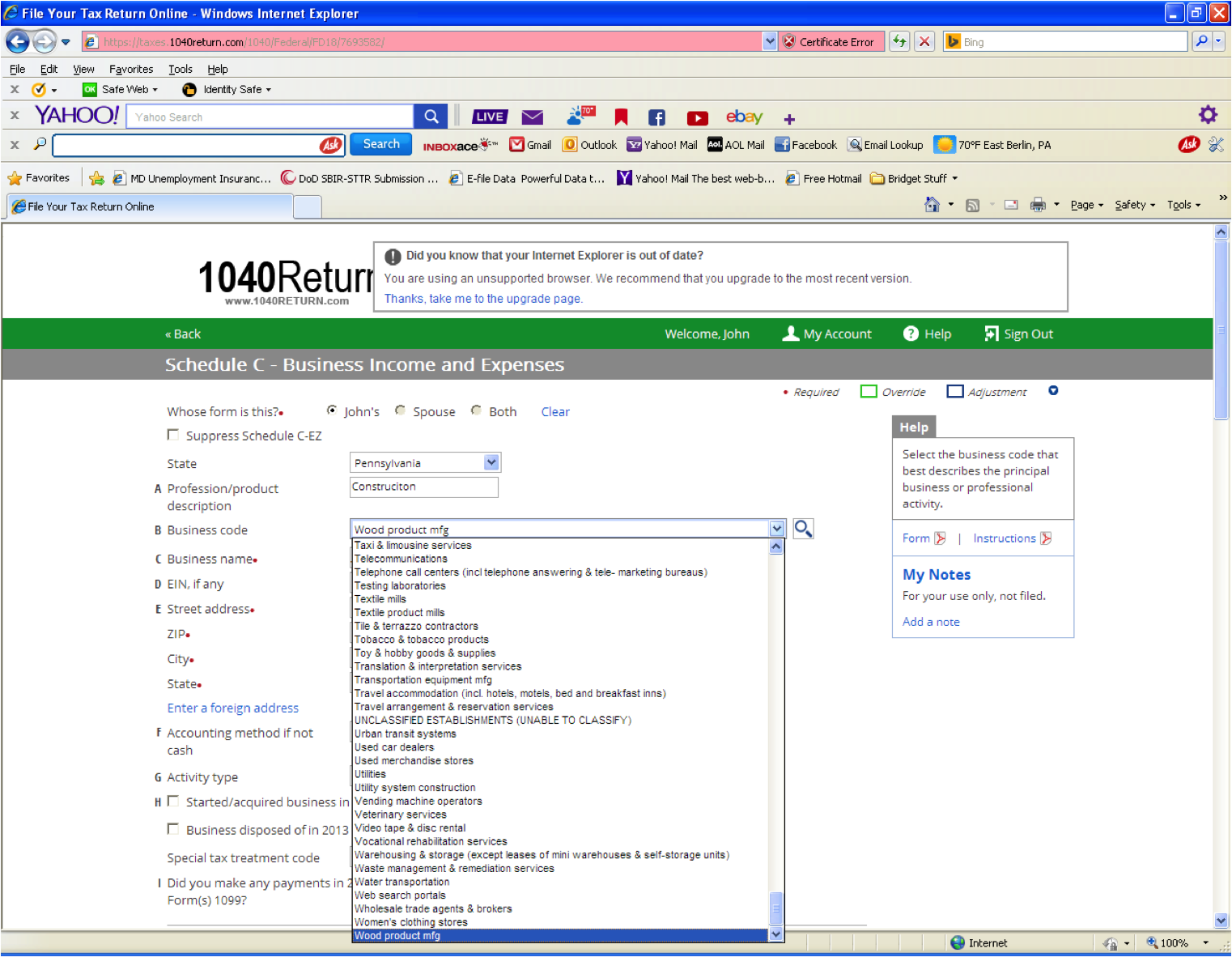

Purchases sales payroll and other transactions you have in your business will generate supporting documents. It was my first time freelancing and i didnt exactly know the rules of the game. These documents contain the information you need to record in your books. Irs audit no records receipts proof evidence or verification.

Irs wants receipts and substantiation but a little known tax rule says you dont have to have receipts. Thanks to the tax case of cohan v. If you receive an irs audit and realize you have no receipts its important to get your financial habits back on track. You can claim deductions and even survive an audit without them.

I worked as a freelance contractor for 7 months in 2013. In a seinfeld episode called the the truth even jerry was undergoing a tax audit. No receipts for your taxes or irs. You can consider professional help from your tax lawyer as it is acceptable by the irs if you bring one along to official meetings as your representative.

The irs provides some flexibility and can take your word that you had allowable expenses. Ive read on the irs website that if you have adequate evidence you don. This is a very popular topic asked by taxpayers. 1930 the irs will allow expenses even if receipts and checks are missing.

If youre a business that deducted expenses and you no longer have receipts it may be logical that you would have expenses that the irs should allow even though you dont have a receipt. Supporting documents include sales slips paid bills invoices receipts deposit slips and canceled checks. If you are being audited by irs and have no receipts there is no need to panic. 2d 540 2d cir.

/cdn.vox-cdn.com/uploads/chorus_image/image/34303963/Bp-PEkICcAAf27y.0.jpg)